Investment trends, market analysis

& authoritative Commentary

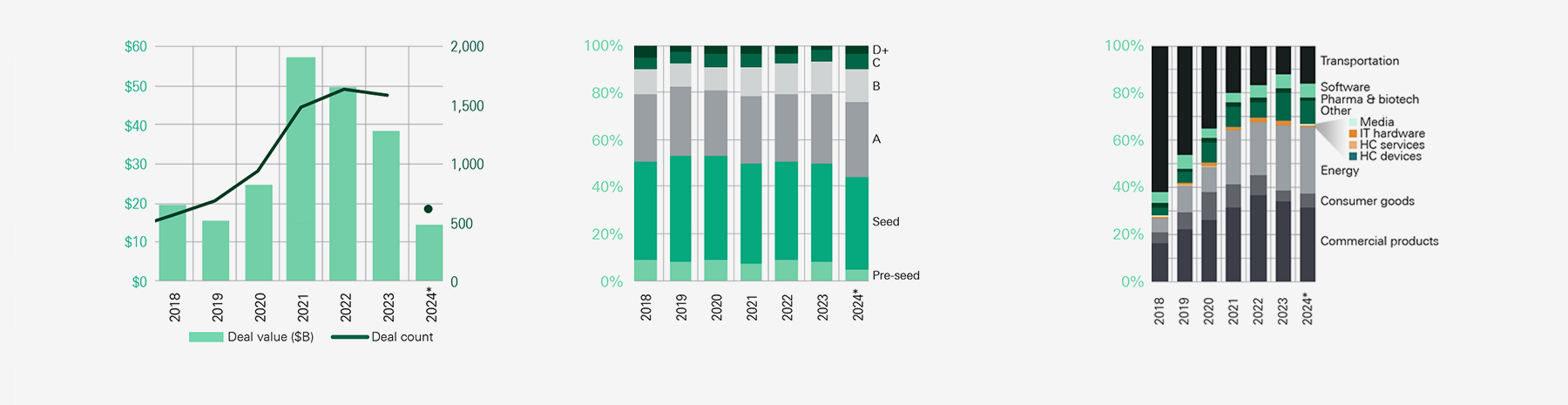

Startups in the climatetech space have raised $18 billion in venture funding across 1,058 deals so far in 2024.

Despite a downturn in VC activity broadly, startup innovation presses forward to keep pace with the growing urgency of the energy transition. Nontraditional investors, or NTIs, and particularly the CVC subcategory, are driving significant growth as global corporates solidify their climatetech positions across nearly $11 billion in deals.

DOWNLOAD THE FULL REPORT

ABOUT

PILLSBURY

Pillsbury is one of the world’s foremost law firms, advising technology companies and their investors, as well as clients in the energy and natural resources, financial, life sciences and digital health, real estate and construction, and other dynamic industries. From microchips to blue chips, Pillsbury advises clients ranging from entrepreneurs and startups working out of a garage to the largest public and private companies. The firm and its lawyers are known for their collaboration across disciplines, authoritative commercial awareness, and market leading practices that are consistently recognized by Chambers & Partners, Financial Times and other publications.

DOWNLOAD THE FULL REPORT

Energy Transition Resource Center

CLIMATETECH

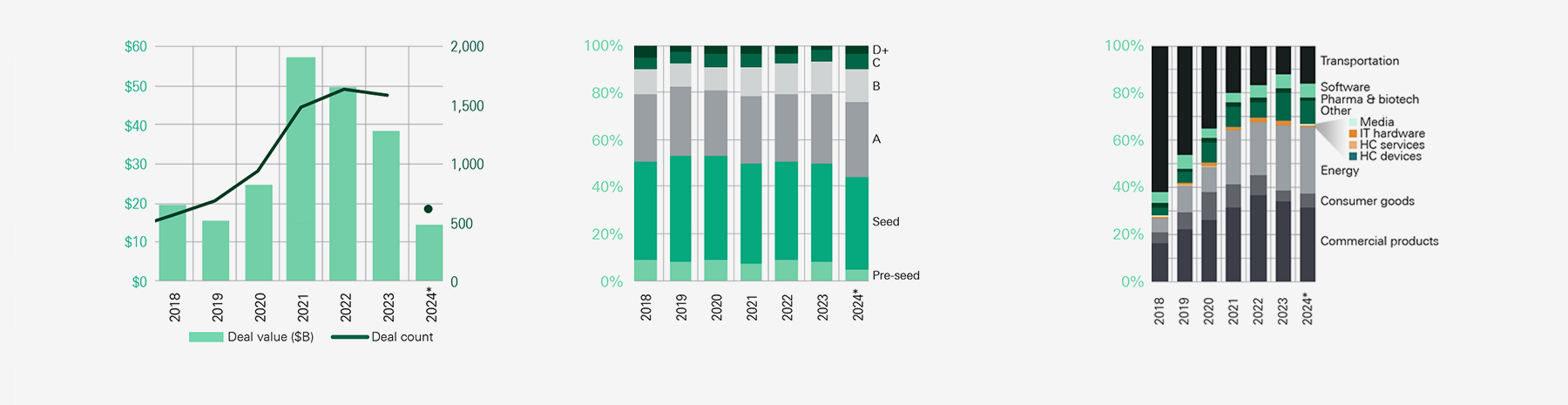

Share of climatetech VC deal count by series

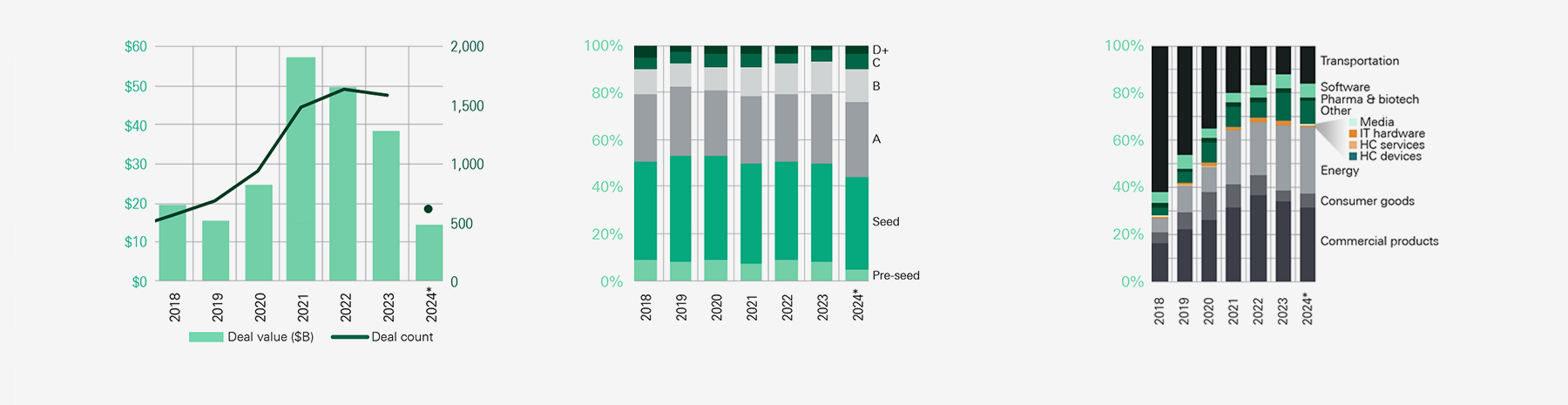

Climatetech VC deal value by industry

CVCs invested $10.9 billion in climatetech startups across 377 deals so far in 2024.

Climatetech startups with an AI component raised $1.2 billion across 114 deals YTD, representing 6.7% and 10.8% of total climatetech VC deal value and count, respectively. Consistent with broad trends, the number of climatetech/AI deals with CVC participation represented more than one-third of the niche's total deal count. And CVC investments in this space were sizable: Their median deal size was $14.3, million, compared to $3.1 million across all climatetech/AI deals.

The intersection of AI and climatetech is maturing as another lucrative investment opportunity as data centers become a major energy demand driver.

Source: PitchBook Geography: Global

*As of August 12, 2024

Climatetech VC deal activity

Climatetech VC deal activity with CVC investor participation

Explore 2021 subsector trends

Download the second report in our series:

Spotlight on Mobilitytech

The biggest share of climatetech VC investments were executed in the early stages, with $7.8 billion across 419 seed, Series A and Series B deals.

Explore 2021 investment

& valuation trends

More than 30% of all VC dollars invested in climatetech YTD went to B2B products and services companies, indicating continued preference for enterprise application innovations.

Explore 2021 climatetech

exit trends

Download Our Spotlight on Mobilitytech

DOWNLOAD THE FULL REPORT

INVESTMENT TRENDS

& THE RISE OF CVC

“All the pain points in the broader venture economy are relevant for climatetech. But there is still a different sense of urgency and resilience in climatetech initiatives, especially with respect to CVCs that have both financial and strategic motives.”

“Data center development illustrates how digital transformation and the energy transition are converging in an urgent way and how important alternative power solutions will be to scale and meet the demand.”

Partner

San Francisco

Paul Casas

Partner

Northern Virginia

Steve D. Ryan

Climatetech:

2023 Year in Review

Climatetech: Investment Trends

& Macro Influences

VIEW THE REPORT

VIEW THE REPORT

Partner

Corporate

Veronica T. Nunn

“As with all new legislation,

it takes time to clarify meaning and implementation, but that's an opportunity to assess

and understand long-term implications and align them with investment goals.”

“Companies that have developed expertise in extracting hydrocarbons from underground reservoirs can now reconfigure their operations to inject captured carbon into those sub-surface structures”

Partner

Energy

Gavin Watson

Emerging Growth & Venture Capital

Emerging Growth & Venture Capital

Partner

Silicon Valley

Christina F. Pearson

“Climatetech companies tend to be very capital-intensive, so they align well with corporate investors who may be more patient and willing to invest for the long-term, given their strategic mandate.”

Partner

Tax

Don Lonczak

“The manufacturing category continues to show resilience, which may be connected to increased interest among investors on the basis of the generous incentives accessible under the IRA.”